Emission Schedule & Release Mechanism

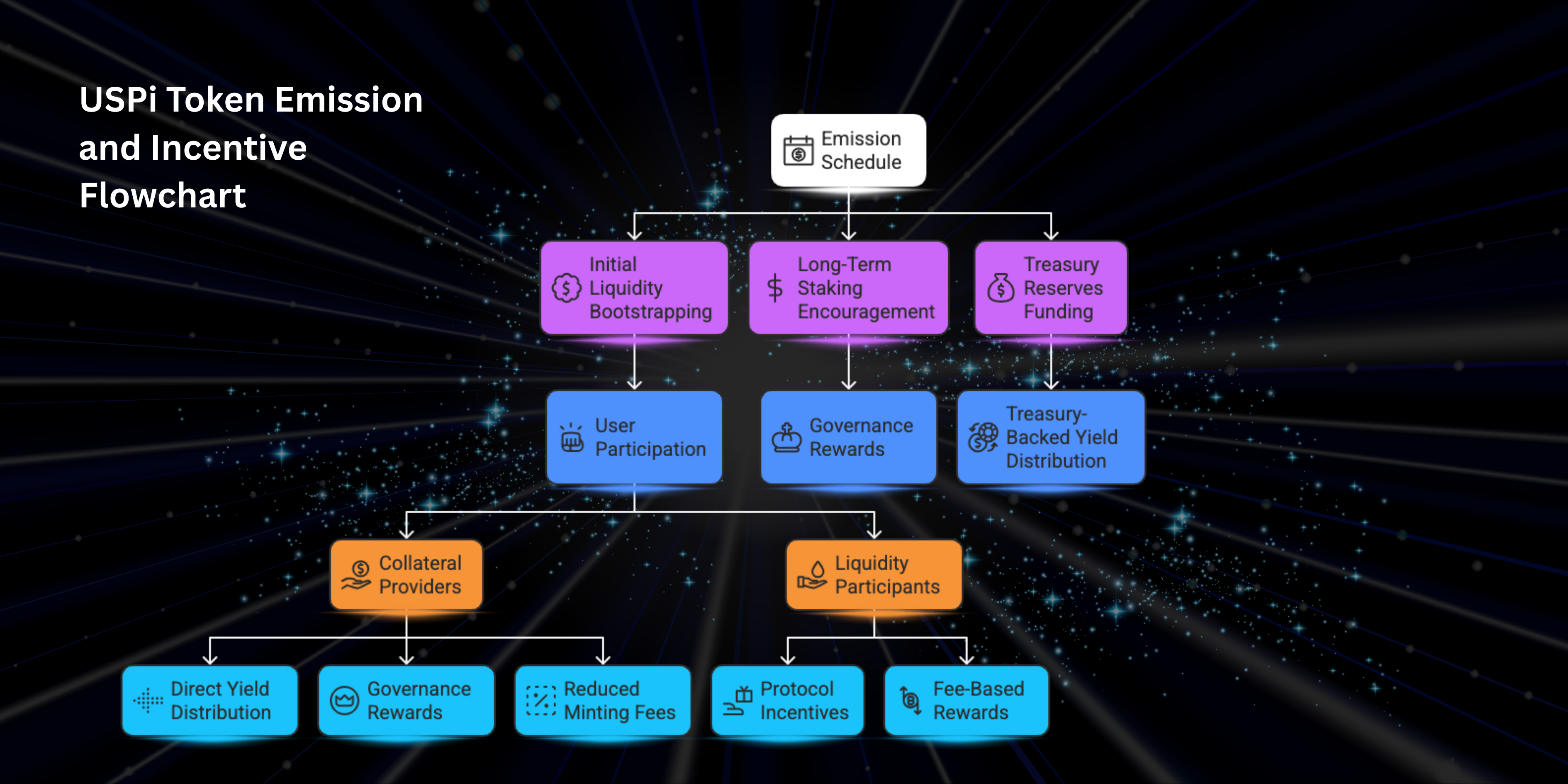

The release of USST tokens follows a phased approach to prevent inflationary pressure and ensure gradual decentralization. The emission schedule is designed to:

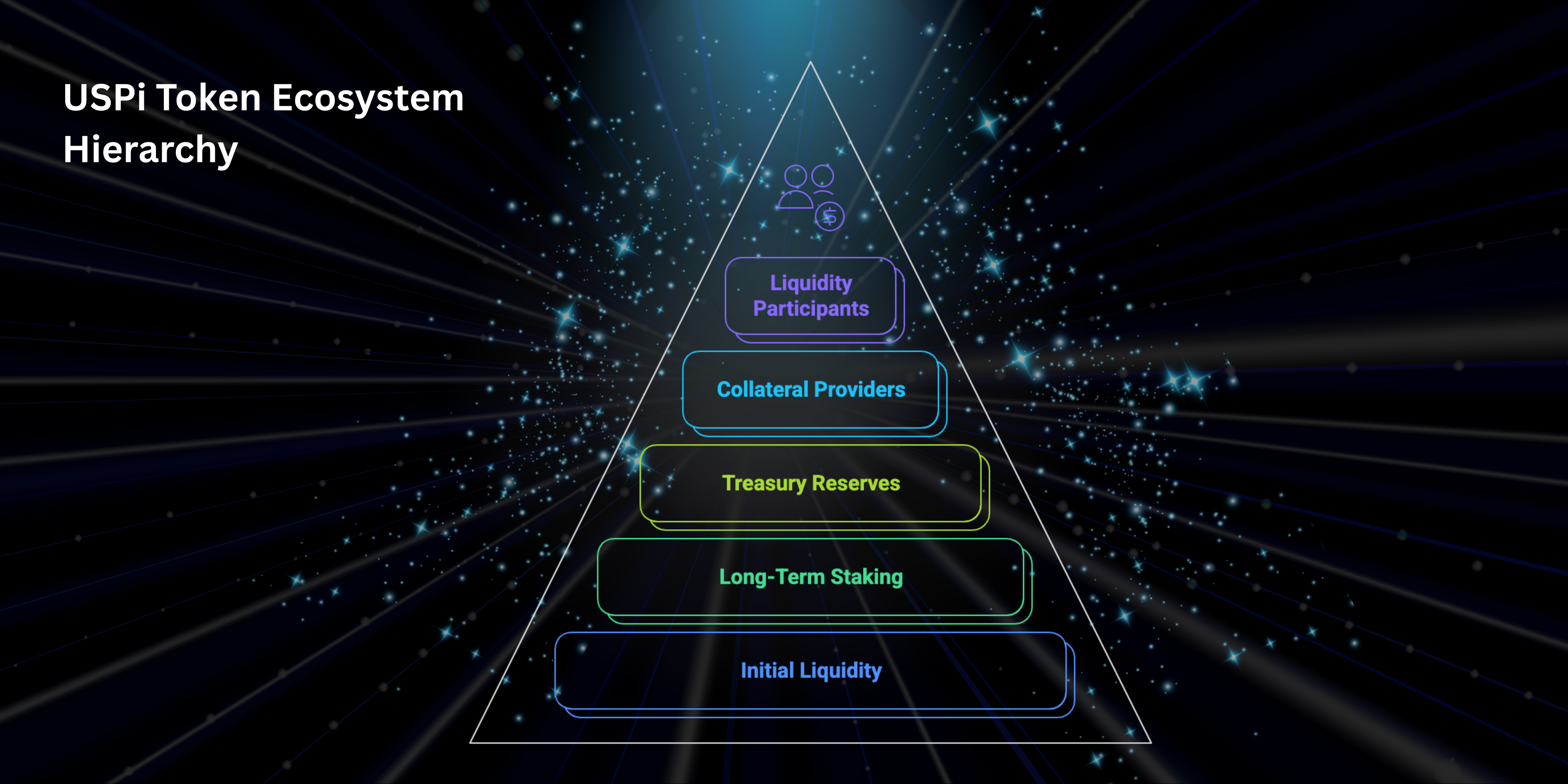

- Support initial liquidity bootstrapping through incentives for users who mint USST or provide liquidity.

- Encourage long-term staking by rewarding participants who lock USST for governance and protocol security.

- Fund treasury reserves for sustainable ecosystem expansion and strategic initiatives.

Treasury-Backed Yield & Staking Incentives

- Users participating in USST minting and liquidity pools receive additional USST rewards, ensuring a balanced distribution of governance power.

- Treasury reserves also back yield distribution, ensuring all issued stablecoins remain fully collateralized.

Incentives for Collateral Providers & Liquidity Participants

STBL ensures that users contributing to the protocol’s liquidity and stability receive direct incentives:

-

Collateral Providers – Users minting USST receive rewards via:

- Direct yield distribution through YLD tokens.

- Additional USST governance rewards for long-term staking.

- Lower minting fees for high-volume liquidity providers.

-

Liquidity Participants – Those contributing to USST trading pools or staking USST earn protocol incentives and fee-based rewards.